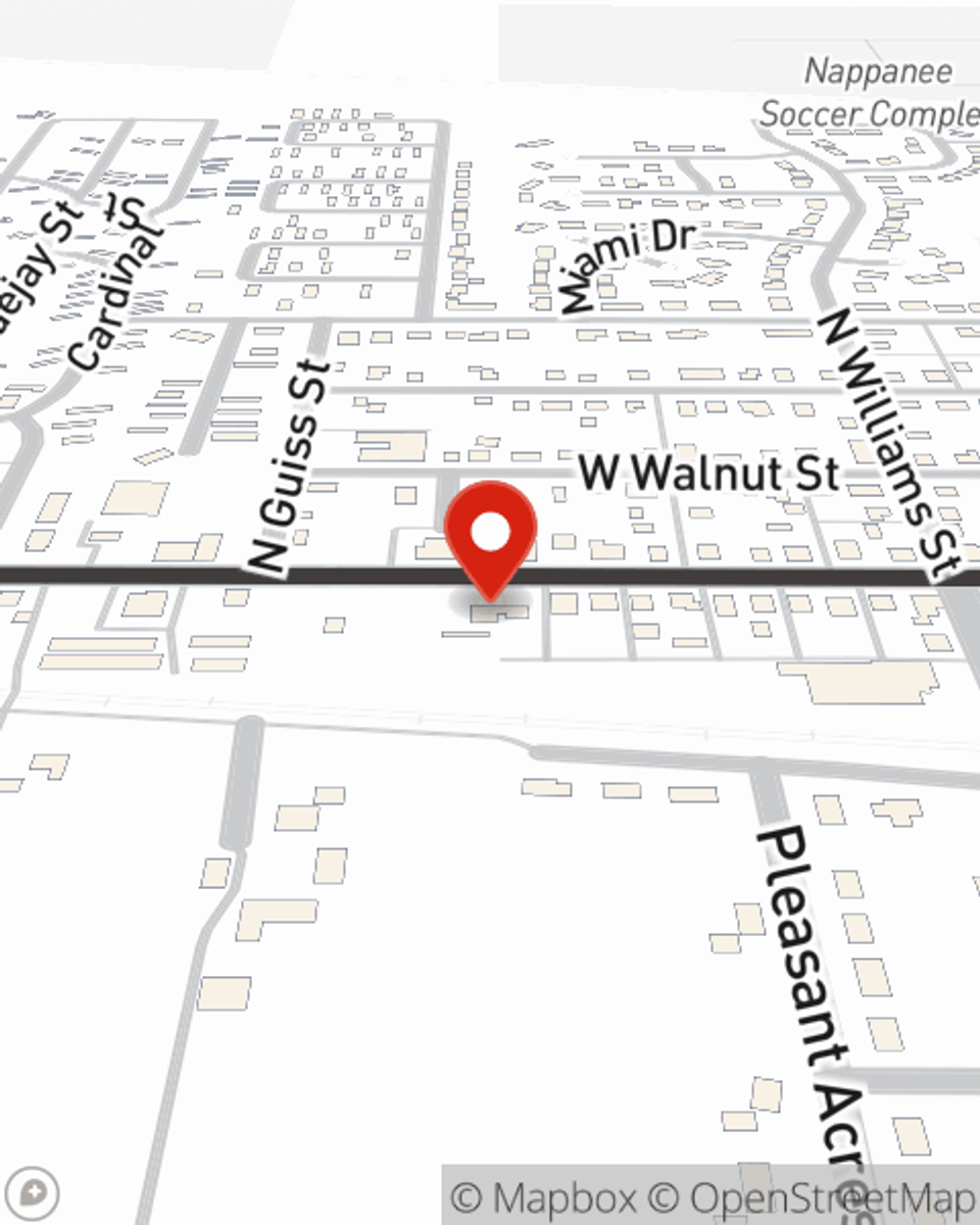

Homeowners Insurance in and around Nappanee

A good neighbor helps you insure your home with State Farm.

The key to great homeowners insurance.

Would you like to create a personalized homeowners quote?

- Indiana

- Michigan

- Ohio

- Elkhart County

- St Joseph County

- Kosciusko County

- South Bend

- Goshen

- Warsaw

- Mishawaka

- Ft Wayne

What's More Important Than A Secure Home?

Committing to homeownership is an exciting time. You need to consider location neighborhood and more. But once you find the perfect place to call home, you also need outstanding insurance. Finding the right coverage can help your Nappanee home be a sweet place to be.

A good neighbor helps you insure your home with State Farm.

The key to great homeowners insurance.

Don't Sweat The Small Stuff, We've Got You Covered.

State Farm's homeowners insurance guards your home and your keepsakes. Agent Sylvia Benjamin is here to help build a policy with your specific needs in mind.

Having exceptional homeowners insurance can be important to have for when the unforeseeable occurs. Contact agent Sylvia Benjamin's office today to put together the right home policy.

Have More Questions About Homeowners Insurance?

Call Sylvia at (574) 773-2886 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Make your windows energy efficient

Make your windows energy efficient

Make your windows energy efficient with simple DIY updates, such as installing storm windows and sealing air leaks with caulk or weather stripping.

Tips for collectible storage and display

Tips for collectible storage and display

Collectibles can have sentimental value and also be a profitable enterprise. So it's important to think about how to store, display and protect your collection.

Sylvia Benjamin

State Farm® Insurance AgentSimple Insights®

Make your windows energy efficient

Make your windows energy efficient

Make your windows energy efficient with simple DIY updates, such as installing storm windows and sealing air leaks with caulk or weather stripping.

Tips for collectible storage and display

Tips for collectible storage and display

Collectibles can have sentimental value and also be a profitable enterprise. So it's important to think about how to store, display and protect your collection.